Rather than relying on yourself to create your own strong passwords, consider using a password manager. Password managers aid in creating, managing and storing your passwords so you won’t forget them. Some password managers like Keeper® even come with the ability to store Two-Factor Authentication (2FA) codes so you can add an additional layer of security to your accounts seamlessly.

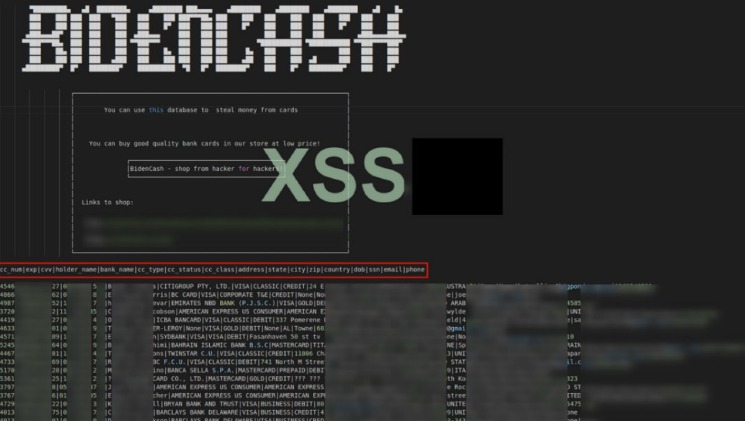

300,000 Credit And Debit Cards Leaked On Dark Web As Hackers Infect Millions Of Devices, Drain Bank Accounts: Report

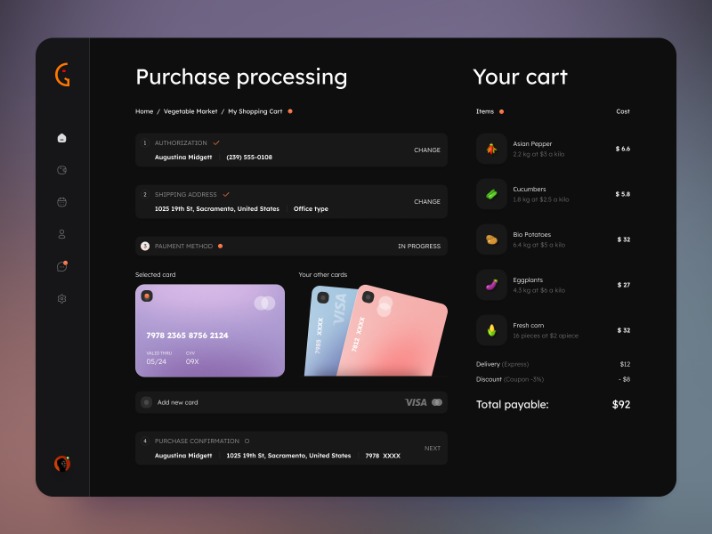

The average price of a cloned, physical card is $171, or 5.75 cents per dollar of credit limit. Comparitech researchers sifted through several illicit marketplaces on the dark web to find out how much our private information is worth. Use multifactor authentication to prevent threat actors from guessing at weak passwords, or getting into your systems with a brute force attack. MFA and strong password requirements will force your employees to use strong passwords and change them often. The payment information is then posted for sale on the dark web where other threat actors can purchase and use it. What many don’t realize is that much of this stolen data comes from large-scale breaches rather than individual card skimming.

Even if a cybercriminal knew your password, MFA would prevent them from being able to log in to your account. Using an unsecured WiFi network, such as one that is public, can place all of your sensitive data at risk due to Man-in-the-Middle (MITM) attacks. MITM is a type of cyber attack where a cybercriminal intercepts the data being sent between two people. A MITM attack most commonly occurs on public WiFi networks because they’re left unsecured and anyone can connect to them.

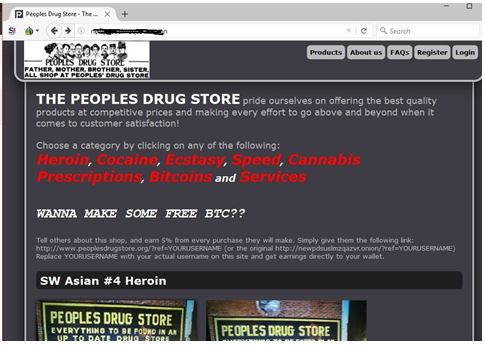

The dark web provides an anonymous and unregulated platform for these transactions, making it difficult for authorities to trace and shut down such activities. The credit cards could come from multiple sources, including from malware forced into online shops, individual user malware attacks, or from breaches of companies who store credit card info. Enterprise fraud teams and CISOs face increasing threats as criminals shift to new platforms where stolen data is shared more openly than ever. But it’s not just the dark web that poses a problem if payment card data is stolen—it’s the entire “cybercrime underground,” says David Capezza, senior director of payment fraud disruption at Visa. Although there’s a variety of goods to be purchased on the dark web, one of the most sold resources by volume on the dark web, if not the most sold commodity, is stolen credit cards.

Be Cautious Of Online Transactions

The leaked database includes details of 1,221,551 credit and debit cards, according to Cyble Research & Intelligence Labs researchers who discovered it. Alongside the obvious sensitive data pertaining to the cards, the dump includes personal information as well, including email addresses, phone numbers, and the address of the card holder. She combines her background in digital marketing from DePaul University with a passion for cybersecurity to create content that helps people and businesses stay secure. Her writing covers everything from password best practices to Privileged Access Management (PAM), with a focus on making technical topics easy to understand. Strong passwords and Multi-Factor Authentication (MFA) help keep your online accounts secure from compromise. MFA is a security measure that adds additional authentication to your online accounts by requiring you to provide one or more forms of verification.

This was followed by Monopoly Market, which became inaccessible early this month in what’s suspected to be an exit scam. Of the Italian cards, roughly 50% have already been blocked due to the issuing banks having detected fraudulent activity, which means that the actually usable entries in the leaked collection may be as low as 10%. The analysts claim these cards mainly come from web skimmers, which are malicious scripts injected into checkout pages of hacked e-commerce sites that steal submitted credit card and customer information.

Million Stolen Credit Cards Given Away Free On Dark Web Forum

Sales of passports, driver’s licenses, frequent flyer miles, streaming accounts, dating profiles, social media accounts, bank accounts, and debit cards are also common, but not nearly as popular. Use a service, like Flare, that allows you to monitor the dark web for any mentions of your organization’s information, including business credit card numbers. Flare, for example, enables you to automatically scan the clear & dark web for any leaked or stolen account credentials. By doing this, you can find your credentials for sale on the dark web and secure them before they are exploited. Stolen credit cards are also harmful to the businesses from which they were stolen in the first place. Customers whose payment information was stolen are less likely to want to continue doing business with your organization after a hack and your organization may sustain long-lasting reputational damage.

Telegram Carding Groups

The cybersecurity firm says the infostealer malware known as Redline was the most prevalent of the data-thieving malware, accounting for 34% of the total infections in 2024. Risepro, which primarily focuses on stealing banking card details and passwords, is another fast-spreading infostealer. Holders of any credit cards, whether you know if they have been compromised or not, are advised to monitor bank statements for any suspicious or unusual activity. If your PayPal account or credit card details end up on the dark web, it’s essential to act quickly to minimize potential damage.

Secure Your Personal Information

On top of all that, they could make purchases or request money from contacts listed in the PayPal account. When it comes to credit card fraud, the best offense is a strong defense. These measures include implementing robust security practices, such as encryption and multi-factor authentication, to protect credit card data and reduce the likelihood of it ending up on the dark web. Earlier this year, a New York man pled guilty to managing a credit card theft scheme responsible for stealing $1,500,000 from 4,000 account holders between 2015 and 2018.

Brief Bio: Real And Rare

To sum it all up, it appears the stolen credit card ecosystem is a widespread issue, with criminals paying little to no attention to the origin, brand, or issuer of the credit card information they are stealing. Credit card fraud in itself is an enormous 32 billion dollars industry, and is only expected to grow in size, upwards of 38 billion dollars by 2027, according to a report by Statista. Imagine entering a dimly lit room, filled with whispers and secrets, where the boundaries of legality blur into obscurity. This clandestine realm is none other than the infamous Dark Web, a hidden corner of the internet that has become a breeding ground for criminal activities and a hotbed of illegal transactions. While credit cards have undoubtedly revolutionized the way we make payments, they too have fallen prey to the nefarious activities that thrive in the depths of this digital underworld. You may be wondering why threat actors would post full credit card details for free, but it’s actually a fairly common criminal advertising tactic.

Carding shops are a type of dark web marketplace that hosts the trade of credit cards and other stolen financial information. These platforms serve as hubs for cybercriminals to buy and sell compromised payment card details. The sooner you become aware of compromised information, such as stolen credit card numbers on dark web, the faster you can take steps to mitigate damage.

When Torrez closed in December it was one of the largest English-language marketplaces in the world selling drugs, hacking tools, counterfeit cash and criminal services. According to the researchers, the Dark Web is “awash” with stolen information. Major brands including MasterCard, Visa, and American Express are common, and stolen data belonging to individuals surfaces from a variety of countries. For many, their bank accounts are at the heart of their financial responsibilities. It’s also the latest in a growing list of criminal marketplaces to have voluntarily closed shop over the past year, including that of White House Market, Cannazon, and Torrez.

This extra layer of security gives peace of mind in today’s digital world. With just a few taps, people can see exactly where their money goes and catch problems early. Judging from the activity on the shop, BidenCash appears to be thriving in 2023, providing an active data and money exchange platform in a market that has experienced a decline in recent years. However, the validity of the data hasn’t been confirmed yet, so it could very well be auto-generated fake entries that don’t correspond to real cards.

- Holders of any credit cards, whether you know if they have been compromised or not, are advised to monitor bank statements for any suspicious or unusual activity.

- These details are needed for physical use such as withdrawing money from ATMs.

- Historically when darknet sites close down, the operators disappear with customers’ or vendors’ money – this is known as an exit scam.

- Russian Market is considered to be one of the most popular, reliable, and valuable marketplaces.

Buyers must navigate through a labyrinth of fraudulent sellers and law enforcement operations targeting illegal marketplaces. It is crucial to exercise caution and take protective measures to safeguard personal information. As reported by Bleeping Computer, in an effort to attract cybercriminals to its platform, the hackers behind ‘BidenCash’ have distributed the details of 1,221,551 credit cards. Credit card skimmers are devices that threat actors use to steal your credit card information. To use these devices, threat actors attach them to actual card readers like the ones used in ATMs and at gas stations. Credit card skimmers are designed to look exactly like card readers so that people aren’t suspicious of them.